The spirit of Bohemia and the ancient art of Patronage have long been intertwined. Kings and emperors, lords and ladies, and citizens of wealth and power generously supported the creative process of poets and writers, painters and sculpturers, actors and musicians. The 'grand tradition' continues today...

Without the support of our generous circle of givers, PacRep Theatre could no withstand the "whipsand scorns of time." We thank the following individuals, without whom our community would lament the loss of so many of our treasured historic and cultural resources.

When Should Making a Gift of a Retained Life Estate be Considered?

Without the support of our generous circle of givers, PacRep Theatre could no withstand the "whipsand scorns of time." We thank the following individuals, without whom our community would lament the loss of so many of our treasured historic and cultural resources.

When Should Making a Gift of a Retained Life Estate be Considered?

- If you have no heirs

- If your children have adequate assets of their own and such property might be a tax burden for them

- If you need a tax deduction

You, your spouse, or other designee can continue to live in your home until the survivor dies. Nothing changes except that Pacific Repertory Theatre ultimately will be able to sell the property and use the income to continue its mission, or use the property for Equity actor housing needs.

How a Gift of a Retained Life Estate Works

- You make a gift of real estate, or your home, and PacRep's name is added to the deed

- You continue to live in your home or make use of the property

- You maintain the property and pay the property taxes (because the gift is being made to a qualified charity, the property taxes will not increase although there is a change in ownership status)

What Are The Benefits?

- You retain use of the property for as long as you and/or your designee live

- You receive an immediate tax deduction when the gift is made

- Property doesn't pass through probate

- You may reduce your estate taxes (depending on the size of your estate)

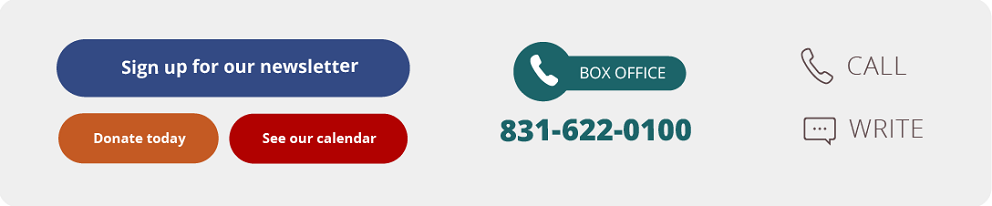

To discuss a contribution or show sponsorship, or to find out more about PacRep Theatre's planned-giving program, please call Executive Director Stephen Moorer or Development Executive John Newkirk at 831.622.0700 ext 4108.

We make no claims regarding the accuracy of the above information or the tax consequences stemming from your use of it. Please consult with your own tax, legal, or financial planning advisor.